Can a DDO consider tax rebates under Sec 80G for school teachers?

80g exemption list or

S.NO | DONEE | Deduction (as a percentage of amount donated) |

1. | National Defence Fund made by the Central Govt | 100% |

2. | Prime Minister’s National Relief Fund | 100% |

3. | Prime Minister’s Armenia Earthquake Relief Fund | 100% |

4. | Africa (Public Contribution – India) Fund | 100% |

5. | National Children’s Fund | 100% |

6. | National Foundation for Communal Harmony | 100% |

7. | University or Educational Institution of National Eminence (approved) | 100% |

8. | Chief Minister’s Earthquake Relief Fund, Maharashtra | 100% |

9. | Fund set up by State Government of Gujarat for providing relief to the victims of the earthquake in Gujarat | 100% |

10. | Zila Saksharta Samiti | 100% |

11. | The National Blood Transfusion Council, State Blood Transfusion Council | 100% |

12. | The fund held by a State Government for the medical relief to the poor | 100% |

13. | Central Welfare Fund of Army or may be the Indian Naval Benevolent Fund or may be The Air Force Central Welfare Fund | 100% |

14. | Andhra Pradesh Chief Minister’s Cyclone Relief Fund | 100% |

15. | National Illness Assistance Fund | 100% |

16. | Chief Minister’s Relief Fund, Lieutenant Governor’s Relief Fund | 100% |

17. | National Sports, National Cultural, Technology Development and Application funds | 100% |

18. | Swachh Bharat Kosh | 100% |

19. | Clean Ganga Fund | 100% |

20. | National Fund for Control of Drug Abuse | 100% |

21. | Jawaharlal Nehru Memorial Fund | 50% |

22. | Prime Minister’s Drought Relief Fund | 50% |

23. | Indira Gandhi Memorial Fund | 50% |

24. 25. | Rajiv Gandhi Foundation Donation towards Bharat Ke Veer fund | 50% 50% |

Deduction available for the amount contributed under section 80G subject to the limit.

Contribution or donation given to any other institution other than discussed above can also get deduction us 80G. However, the deduction in respect of such donations or contributions will be restricted to 50% or 100% of the Net Qualifying Amount.

The following table describes the funds where contributions/ donations made are eligible for deduction from GTI (Gross Total Income) subject to the qualifying limit as:

TABLE- II

S.No. | Particulars | Deduction (as a percentage of net qualifying amount) |

| Donation to Government or any local authority approved by govt, institution, or association to be made for the purpose of promoting family planning. | 100% |

| Donation given by any company to the Indian Olympic Association or to any other association or institution notified for the development of infrastructure for sports and games in India or the sponsorship of sports and games in India. (Note: Only the companies are eligible to claim deduction under this i.e. this is not available to any other assessee.) | 100% |

| Funds/ Institutions which accepts conditions mentioned under section 80G(5) | 50% |

| Donation to Govt or any local authority for the purpose of utilize any charitable purpose other than promoting family planning | 50% |

| Any body made in India for satisfying the needs for housing accommodation or for the purpose of planning/development of towns, villages, etc. | 50% |

| Any corporation specified U/S 10(26BB) for the promotion of the interest of minority community | 50% |

| Any notified (by govt for tax purpose) temple, mosque, gurdwara, church or other places for the purpose of renovation & repairs | 50% |

Net Qualifying Amount means 10% of the adjusted GTI i.e gross total income or the donations/ contributions made (excluding the donation/ contribution to the specified funds as mentioned in Table-I), whichever is less.

How to calculate Adjusted Gross Total Income (AGTI)?

Deduction = 50% or 100% 10% of AGTI

(as the case may be)* Or (Whichever is less)

Total donations u/s 80G

*Refer Table- II

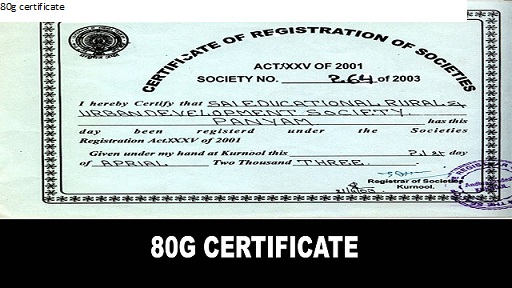

What Payment proof is needed to be submitted to claim deduction under section 80G?

The assessee claiming deduction under section 80G is required to present payment proof. The assessee should submit the receipt as jpg or pdf file in portal issued by the donee-institute to get the relief of the deduction. Such receipt should indicate name, address, PAN and the registration number of Donee under section 80G along with the validity of the registration and the name and amount donated/ contributed by the Donor.

Payment proof in case the employer donates by way of consolidated cheque?

In the case where donations/ contributions are made to:

- National Defence Fund

- Army Central Welfare Fund

- Indian Naval Benevolent Fund

- Air Force Central Welfare Fund

- National Relief Fund

- Chief Ministers Relief Fund

- Lieutenant Governors Relief Fund.

Apart from the economy this really helps to ensure sustainable development across all over India. If you want explore more about economy click that

after all this procedure 80g certificate will be issued to you, following is the simple

0 comments:

Post a Comment