Types of costing or How many costing methods are there?

before going deep into types first understand what is costing?

In very simple word its a process which go through a bunch of technical,financial & analytical process to determine the cost of the products or services.

section A:- STRATEGIC COST MANAGEMENT TOOLS

AND TECHNIQUES

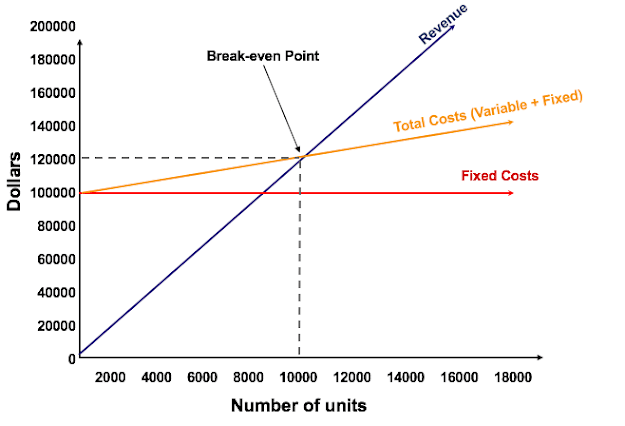

- Differential bassed costing-CVP Analysis –

- Profit Volume Analysis by graphical presentation –

- Contribution by limiting factor Approach

C= contributionS= selling priceV= variable cost

where

C= F

|

| source : cfi |

- Maximum utilization of raw-materials & resources –

- Make or Buy –

- Evaluation of Orders –

- Multiple scarce resource problems-

- Product minimum maximum sales pricing….. etc.

- New Product Pricing after evaluation ,

- Use of Costs in Pricing,

- Sensitivity Analysis ;

- Monopoly vs. Competitive Pricing;

- Bottom Line Pricing.

- methods,

- pricing,

- performance

- measurement

- Object,

- Methods of doing

- Cost Based,

- Market Price Based,

- Negotiated Pricing

- Advantages and limitation,

- platform for making Transfer Prices,

- Transfer Price in various situations,

- cause of Conflicts and resolve the Conflicts;

- Relevant and Irrelevant Costs with multiple factor -

- Sunk cost which is also known as Historical Cost,

- Committed Cost (which is also part of relevant cost)

- Absorption Costing,

- such kind of Situations where Fixed Costs become important to take into account for decision making and its related implications. as an example :-rent for cold storage

- Transportation:-

optimal distribution of cost by mostly 3 method:-METHODS OF SOLVING TRANSPORTATION PROBLEM:

1. The north-west corner rule2. Lowest cost entry method3. Vogel’s approximation method

- SIMULATION :-

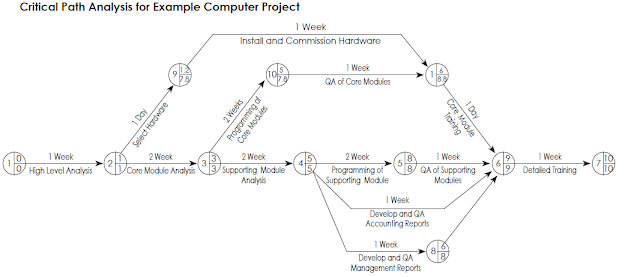

- NETWORK ANALYSIS – CPM/PERT:-

Network analysis gives us to calculate a systematic structural approach to the problem of managing a

project up to successful completion. Also, because of graphical representation, it can easily understandable

and it can also be used by those with a less technical background.

- LEARNING CURVE

first time it takes more time than future cause it is new process, employees are new to that skill & less production.but when it continue for sometimes then overall time taken became less like the following graph.

- LINEAR PROGRAMMING

ASSIGNMENT

now its time to see how to record these cost transaction:-

- Historical or traditional method :-

- Inventory management :-

For good inventory management system some Technics were developed, these are:-

- FIFO :- First in first out

- LIFO :- Last in first out

- Weighted average :- in & out will be based on weighted average.

- Simple average :- in & out will be based on normal average.

- Re-order level :- The time when order may be given

- Danger level :- The time when order should be given.

- Activity Based Cost Management

At present it is the best method to record the transaction.A more accurate cost management system than traditional cost

accounting; ABC identifies opportunities to improve business process effectiveness and efficiency by determining

the “true” cost of a product or service. Activity Based Costing is a method for determining cost estimates in which

the project is subdivided into section, quantifiable activities or a separate work unit. ABC systems gives us the costs of

individual activities which enable us to determine the actual cost of the each product.

Now after recording its time to analysis the over all work to determine work is done as per Plan or not :-

1.Bench Marking :- matching with competitor

2.Total Quality Management (TQM) : total analysis of quality of work

3.Praise Analysis:- Identification of improvement opportunities and implementation of quality improvement process, of the TQM

Process goes through by six-step activity flow, identified by the acronym ‘PRAISE’.

- P= Problem Identification

- R= Ranking

- A= Analysis

- I = Innovation

- S = Solution

- E= Evaluation

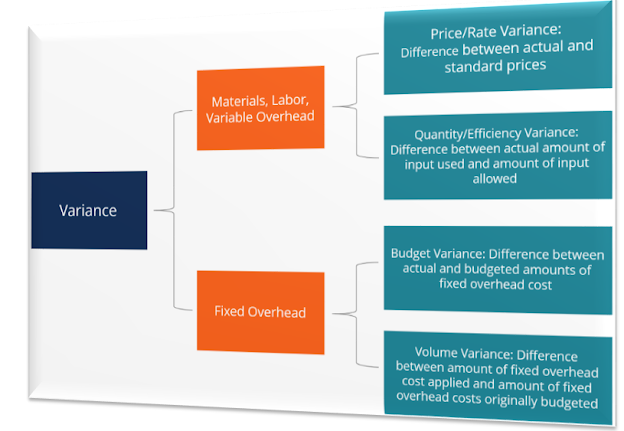

4.Variance Analysis:-

After all this analysis there will be some part which can be developed for the activity.

- Life Cycle Costing

- Target Costing

- Kaizen Costing

- Value Analysis and Value Engineering

- Throughput Costing

- Business Process Re-engineering

- Back-flush Accounting Lean Accounting

- Socio Economic Costing

- Cost Control and Cost Reduction – Basics, Process, Methods and Techniques

- of Cost Reduction Programme

- Six Sigma

- Pareto Analysis

- Quality Costs

- 6C’s and 4P’s.

Times of economic US, China, India, Sweden, Denmark, Globe:-

0 comments:

Post a Comment