Why Vedanta is going to delisting its share from stock exchange?

It means you can’t trade this share any more. The owner of the company Anil Agarwal proposes to delisting the share or Vedanta plans to go private

For this we have to know what is delisting?

Listed share means any companies share which is got permission to be traded in recognized stock exchange such as BSE, NSE. And delisting share means shares which trader can’t buy or sale in recognized stock exchange like NSC BSE.

SEBI (Delisting of Securities) Guidelines, 2003

As per this Act it is bifurcated in two types.

1. Voluntary /Not mandatory

2. involuntary / compulsory/

also read Why Yes Bank failed?

- Involuntary/compulsory:-

When any company fails to adhere to regulatory norms as per Company Act 2013 or became bankrupt and all authority step in overnight.

Grounds of delisting

A recognished stock exchange may delist the securities of a company on any ground prescribe under this act :-

Prescribr grounds are under [ rule 21 of securities Contract (Regulation) Rule,1957 ]

(a) the company has incurred losses during the preceding three consecutive years and it has negative networth;

(b) trading in the securities of the company has remained suspended for a period of more than six months;

(c) the securities of the company have remained infrequently traded during the preceding three years;

(d) the company or any of its promoters or any of its director has been convicted for failure to comply with any of the provisions of the Act or the Securities and Exchange Board of India Act, 1992 or the Depositories Act, 1996 (22 of 1996) or rules, regulations, agreements made thereunder, as the case may be and awarded a penalty of not less than rupees one crore or imprisonment of not less than three years;

also read Does printing more money save our economay?

(e) the addresses of the company or any of its promoter or any of its directors, are not known or false addresses have been furnished or the company has changed its registered office in contravention of the provisions of the Companies Act, 1956 (1 of 1956); or

(f) If share of the company held by the public has come down certain minimum level applicable to the company as per the listing agreement under the Act and the company became failed to increase public holding to the required level within the time limit specified by the stock exchange

- Voluntary /Not mandatory :-

When management of company decided to delisting the share.

Now lets see how its done

Step 1

Quarterly Compliance Certificate- Listed entity shall submit a quarterly compliance report on corporate

within fifteen days from close of the quarter

Details of all the material which actually traded as related party transaction during the quarter need to be disclosed

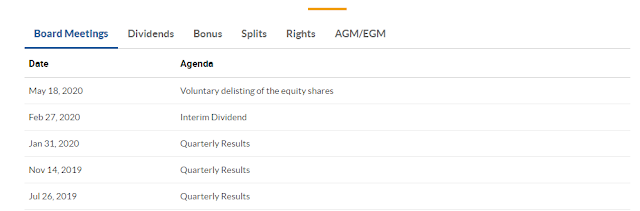

Prior intimations from Stock Exchanges – Reg 29

Meeting of Board held for following matters

◦ financial results viz. quarterly, half yearly, or annual

◦ proposal for buyback of securities;

◦ proposal for voluntary delisting

◦ proposal for fund raising

◦ declaration/recommendation of dividend,

◦ proposal for issue of convertible securities.

Step 2

All the taken decision is sanctioned by making a special resolution singed by director. And sent it to SEBI within 15 days from that board meting.

Step 3

After getting approval from the SEBI,The company announce the news of delisting. Then after meeting with shareholders they decide the buyback price. Buyback means buying the shares from shareholder by the company. Now it can take may be a long time. In example Essar oil delisting took 4 years to conclude.

Delisting will not be successful until 90 % of share of the company’s share are not acquired.

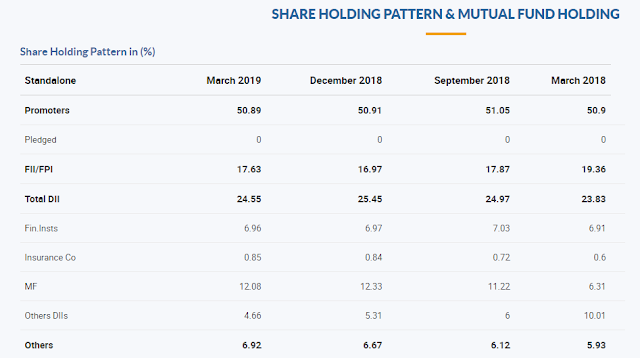

Now the thing is that Anil Agarwal wants to buy back its minority portion shares which consists 48.94% of total share which valued as per 11th May 15, 2020 closing price is Rs 33194 crore.

He offers it shareholder to buyback share at Floor price Rs 87.5, which include 9.9% of premium over 11th May 15, 2020 closing price Rs 79.6. that means he is

ready to give Rs 36488.379 crore for Rs 33194 crore value shares .

Now the question Is it the last price

shareholder expect?

also read COVID-19 impact: in Economy GDP, Bank,Real estate,Agriculture,automobile & forecast

The answer is NO, it is just a beginning,

shareholders will be given many chance to

manipulate the price, simply it has also a

concept of bargaining. SEBI will not going to

disappoint its shareholder. Now it appoint a

merchant banker that will decide the price by

method called reversed book building.

In simple word how our mother bargain with shopkeepers for a product & makes it less price. Now the role of the merchant banker is almost same. In this They make reversed bargain .

But the main factor is why Anil Agarwal is delisting Vedanta now?

As per Agarwal “Corporate Simplification” is the triggered behind the move

Is it?

Ok lets brake the factors.

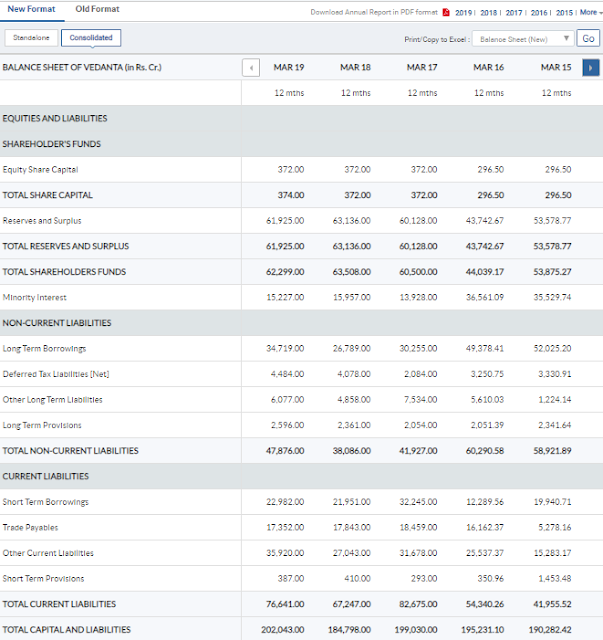

After lockdown share price became low as half as 52 weeks high i.e Rs 180. & besides that Vedanta has huge debt to repay which valued $1.9 billion or Rs 14250 crore + regular interest in financial year 2021.

So it is very clear to us that in FY 20-21 profit will be very less. & where the price is almost Became half. They don’t want take any risk for future. This is why they want delisting.

Om 18th May 15, 2020 Board of directors will do a meting on this matter. May be it will accepted or rejected by taking various factor which include the due diligence report submit by merchant banker & approval from shareholder by a special resolution voted in postal ballot.

So how many vote it need ?

2/3rd or 66.67% of total vote.

so don't be upset you will get a chance to present your word to them even you are holding only 1 share.

0 comments:

Post a Comment